September 11, 1923 – February 22, 2023

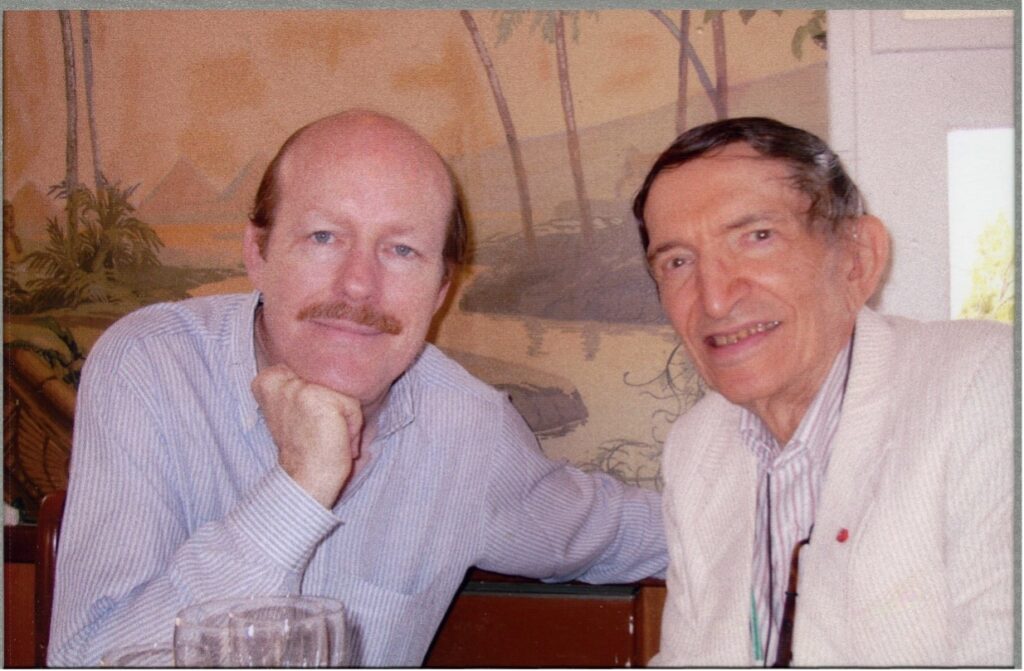

By Scott C. Tips

The first time I ever saw Harry Schultz he was walking in the Fontvieille district of Monaco. That must have been around 1997. I was just returning home from a grocery-shopping foray to the large Carrefour supermarket there and was surprised to spot him, large as life, out of my car window as I drove past him. I had already been a subscriber to his The International Harry Schultz Letter since 1979, owned several of his books, and I knew what he looked like, so I was sure that was him. Since he was local, I determined that I would meet him. And I did.

He responded to my letter and consented to meet with me, which we did at a brasserie in Monaco. We both had tea, as I remember, and our discussion was wide-ranging and deep, shifting from politics to economics to philosophy to investing and all the way to women (yes, we both agreed, you cannot live without them!). Once his guard was down, Harry was friendly, warm, and we immediately became fast friends, a friendship that was to last for 26 years. A treasure trove of information, his mind was sharp and receptive to new ideas, even unto death. He was always learning, just as he was always teaching.

Born in Milwaukee, Wisconsin and reared in California, Harry served in the U.S. Army during the Second World War and was stationed at its end in Shanghai, China, where he learned to trade in the stock and currency markets, amassing a small fortune through his trades on the Shanghai Stock Exchange. He then parlayed that money into a newspaper purchase in Palm Springs, California. At one time he owned 13 newspapers and was nominated for the Pulitzer prize.

Although publishing was in his blood, his genius for making money trading stocks and currencies only sharpened with time and he seemed to increasingly focus on using those skills. He developed a financial consultancy business based on technical stock analysis and hard-money assets and charged $2,000 per hour for his advice. He was listed in the Guinness Book of World Records as the highest paid financial consultant in the World, a distinction he enjoyed until his death. His market “Bible” – a copy of which he convinced me to purchase many years ago – was Edwards and Magee’s Technical Analysis of Stock Trends, now in its 11th edition.

A true maverick in every sense of the word, Harry was a hard-core libertarian, a voracious reader, and very knowledgeable and outspoken on all subjects. He coined the term “Stagflation” to describe the worst-of-both-worlds situation where an economy is confronted with slow growth, high unemployment, and inflation. Harry believed in decentralizing nations, the smaller the better – the exact opposite of today’s global-government advocates. Most of all, he believed in the benefits of dietary supplements, health freedom, and the goals of the National Health Federation, several times mentioning the Federation in his financial newsletter and, at my request, becoming NHF’s Financial Advisor in the Summer 2005.

Harry wrote a number of books, including Bear Markets: How to Survive and Make Money in Them (1964), Handbook for Using & Understanding Swiss Banks (1970), Panics & Crashes and How You Can Make Money out of Them (1972), Financial Tactics and Terms for the Sophisticated International Investor (1974),and On Re-making the World: Cut Nations Down to Size (1991). And, as an iconic figure, he was mentioned or depicted in many other books, such as Matlock and Silber’s Who’s Who in Hard Money Economics (1980) and Arthur Hailey’s bestselling 1975 novel The Moneychangers.

Harry influenced and helped people worldwide. I remember one Autumn, he called me out of the blue and insisted that I sell all of my short positions in the market. I did, and that one phone call saved me thousands of dollars that I otherwise would have lost. Even though he traded the markets using technical analysis, he seemed to have an instinctive and intuitive grasp of market currents and trends.

Sadly, near the end of his life, I saw very little of my friend Harry. I had moved away from his normal haunts and his own mobility had declined. We mostly traded emails for a while. But, year after year passed and Harry kept celebrating his birthdays, the last of which I was able to attend in 2011. I was rooting for him to reach 100. Then, this year, I received word from his wife Joy that he had died peacefully, in bed, and surrounded by family and friends. He was 99-1/2 years old.

Very nice writeup. I was one of harry’s stockbrokers. I used to read his newsletter with a flashlight at age 8 under the covers in my bed at night.

My dad had it and left it on his desk, told me i was too young to read it and to leave it alone. I didnt… lol.

God Bless Harry.

cheers st

I just found out that Harry Schultz was my father’s first cousin, so I am reading everything I can about him.

Looks to be a very interesting man!.

I worked for Harry for a short time, (’78-’79) updating hundreds of stock charts daily while he lived in London. As a young Anerican woman this was the most interesting time of my life. He was a character.

I started reading HSL back in the early 1970’s. Friends from San Diego subscribed and would send me copies and I in turn would photocopy for one of my friends. This is how st got the copy to read in bed with a flashlight.

After a few years I felt guilty reading photo copies and sent Harry a letter apologizing and paid for a lifetime subscription. He acknowledged my sinful behavior in his next letter and all was forgiven.

Harry’s letters had so much information that even today there is nothing like it.

Thanks Harry for helping me learn some of the complexities of investing. A very thorough write-up.

Sir Harry first “discovered” me when we were both speakers at an International Financial Conference, in Acapulco, Mexico. I was in my twenties, and new to the investment field, but, my passion for gold was very apparent, since I was involved in nearly every facet of it. I was elected to The World Gold Assn, in Lausanne, Switzerland, when Sir Harry heard my speech on Gold: He contacted then WGA President, Robert Dorn, & insisted that I be added to all of Sir Harry’s activities, describing me as “a human dynamo.” I was very privileged to be mentored by him in investments, absorbing his extensive knowledge on gold, as well as other financial instruments & global finance. Never acting pompous, arrogant or condescending with me, he often got out his pocket notepad & pen during our meetings, and he jotted down my advice and comments. I was delighted to be appreciated by one as extraordinary & well-versed as was Sir Harry. Sometimes he even put my quotes in his famous “The Harry Schultz International Letter.” Harry also had an amazingly dignified demeanor, & was respectful towards me, at a time when women were not taken very seriously in the financial world. Later, when I was hired by his Highness Sheikh Zayed Al-Nahyan and other royals in the Arabian Gulf, I returned the favor to Sir Harry for his astute tutoring, by connecting him to local investors in development projects in “Jebel Ali” area of Dubai. Often, we visited and discussed global investments, sometimes taking time for fun, such as when I brought a life-size gorilla to a pub, when Harry was living in the Chelsea area of London, and we sat the stuffed gorilla at the bar, & put a cocktail in the gorilla’s hand. Everyone who entered the pub was surprised & delighted to get a big laugh from our “April Fools” gesture. I felt that Harry was American in his investment strategy, but, he had spent so much time in Europe, (where he was given the title of “Sir” by the Knights of Malta), that his personality definitely straddled both worlds. After England got almost as bad as USA with income taxes, he moved to Monaco, where he eventually passed away. He was one of a kind, for sure. A giant in the financial investment field. One of a kind. SaleeAmina.info SaleeAmina.org SaleeAmina.com YouTube: Salee Amina

He was a great story teller and people who believed they really knew him only knew the version of himself he wanted them to see depending on the story line.

I was introduced to Harry’s newsletter by Dr Wally Stonehouse in 2001 when i started my hedge fund and became a subscriber and grew to relish each new addition. I am sad to read of his passing and now will endeavor to read past issues in the coming years as i look forward to having more time. I would very much like to have known what Harry would think of the world today

Michael

Harry dated my mother. Jennifer Anne Wilson. From Richmond London. Put a advertisement in timeout. She worked for him as a pr around1985. He like several kinds of nuts at a certain time of day